Fire Dues

Fire & EMS

- After the Fire

- Burn Permit Application

- Burn Ban & Wildfire Status

- Department Roster

- Emergency Preparedness

- Frequently Asked Questions

- Fire Dues

- Fire Marshal’s Office

- Incident Report Request

- News & PressMayflower Fire Department

- Open Burning Laws

- Pafford EMS

- Recruitment

- Report Issues

- Response Area

- Services Provided

- Stations & Apparatus

- Storm Shelter Registration

The Mayflower Fire Department is the largest fire district in Faulkner County and receives no direct funding from the City of Mayflower or Faulkner County. All operating revenue is generated off of special assessment fees levied on property taxes and Act 833 funds. The Mayflower Fire Department applies an assessment fee on every parcel within the Fire District commonly referred to as “Fire Dues”. The fee schedule is listed below.

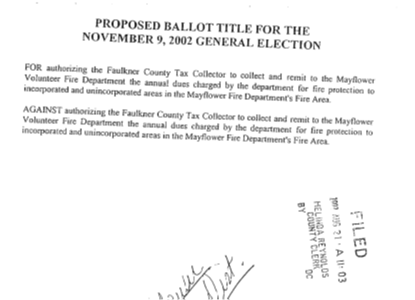

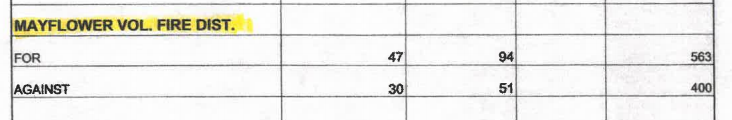

The voters within the Fire District authorized the Fire Department to place the “dues charged by the department for fire protection to incorporated and unincorporated areas in the Mayflower Fire Department’s Fire Area” and have it collected with property taxes in the General Election in the fall of 2002. This vote passed 563 for and 400 against.

Copies of Ballot & Vote Results

Standardized District Fee Schedule

Residential Parcels

Livable structure includes traditional homes, mobile homes, RV/ campers used as fixed dwellings and sheds converted to living spaces. This does not include barns, shops, carports, boat houses, etc.

1 Livable Structure; Less than 20 acres – $65

2 Livable Structures; Less than 20 acres – $130 (doubling fee)

3 or more Livable Structures; Less than 20 acres – $135 ($5 additional for all other structures)

Unimproved parcel minimum charge (1-20 acres) – $10

All residential parcels are an additional $1 per acre over 20 acres

Commercial Parcels

All commercial parcels with a commercial building on the parcel will be assessed a minimum of $135 whether occupied or not. Buildings over 6,750 sq/ft. will be assessed at $0.02 per square foot.

Total building footage less than 6,750/sq. ft. – $135

Total building footage greater than 6,750/sq. ft. – $0.02/sq. ft.

Additional $1 per acre over 20 acres

Maximum fee of $1,000 regardless of building size or acreage

Unimproved commercial parcel minimum charge – $10

Agricultural Parcels

Parcels used for farmland and/or agricultural purposes are charged $1 per acre after 20 acres

Mobile Home and Trailer Parks

Each manufactured home, regardless of how many are on a given parcel, will be charged $50 per home..

Multi-Family Apartments

Each individual unit will be assessed $200 per building regardless of how many individual units there are.

Duplexes

Duplex units will be charged the commercial rate of $135 per building.

Firefighter Owned Parcels

Firefighters that actively participate with the Mayflower Fire Department will be exempt from paying fire dues on their parcels and property.

Annual Reports

Standardized District Fee Schedule

Mayflower City Center

City Phone Directory: (501) 470-1337

Monday – Thursday, 7:00 am – 5:30 pm. Closed on Friday.